While federal No Surprise Billing Independent Dispute Resolution (IDR) has only existed since 2022,...

Growing Backlog Frustrates Healthcare Providers and Insurers Under No Surprises Act

While ongoing litigation and shifting rule interpretations have led to a rocky start since the 2022 launch of the No Surprises Act, they are not the only hurdles frustrating providers and payors. Unexpectedly high demand for the federal Independent Dispute Resolution (IDR) process is contributing to claim delays and a mounting backlog of disputes.

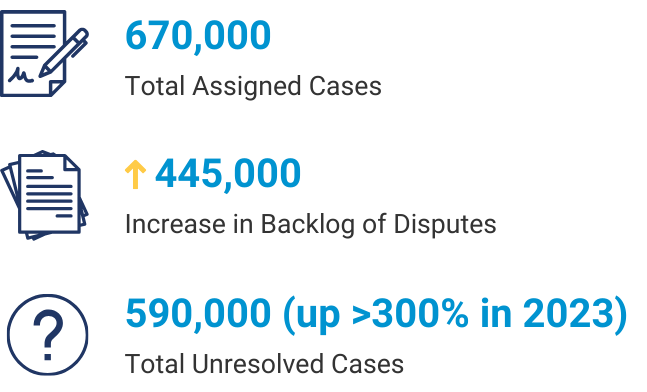

According to a December 2023 report from the U.S. Government Accountability Office, officials anticipated approximately 22,000 disputes in 2022. The reality far outpaced the estimate, with more nearly 200,000 disputes initiated before the end of 2022 and another 670,000 submitted during 2023.

Overwhelmed by demand, a backlog of disputes has grown with approximately 590,000 remaining unresolved at the end of 2023.

Eligibility Determination a Larger Problem than IDR Process

According to the report, a primary cause of the large number of unresolved disputes is the complexity of determining whether disputes are eligible for the IDR process.

For eligible disputes, the Centers for Medicare & Medicaid Services has established a clear timeline and rules to govern the completion of each step.

While each certified IDR Entity is held to the same standard as providers and payors when it comes to these timelines, the capacity to determine a claim’s eligibility for IDR and to complete the process in a timely manner varies widely among the certified entities.

As the clarity of the rules under the No Surprises Act continues to come into focus, the most effective way to minimize the backlogs is to trust a knowledgeable IDR Entity with a proven track record of efficiency. A more experienced IDR Entity will be better equipped to assess eligibility faster and with more accuracy than other entities.

Those entities that are unable to meet the requirements of the No Surprises Act, or that otherwise fail to comply with the IDR process can risk losing their certification to continue performing IDR services on behalf of the federal government.

FHAS Leads the Way in IDRE Performance

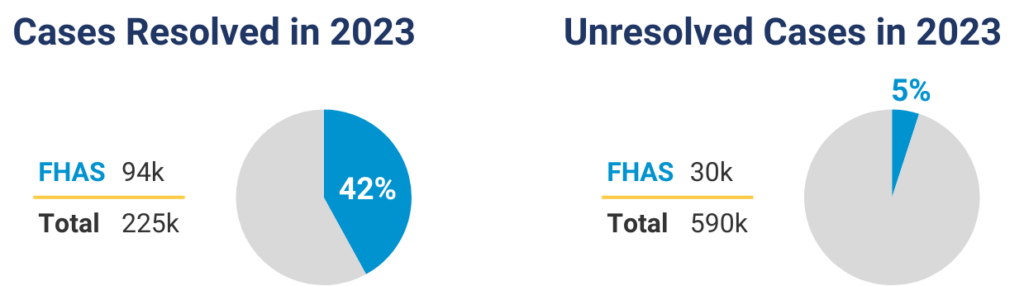

In 2023, FHAS closed an estimated 42 percent of the resolved IDR cases across all certified entities. In addition, unresolved cases at FHAS accounted for just 5 percent of the industry total.

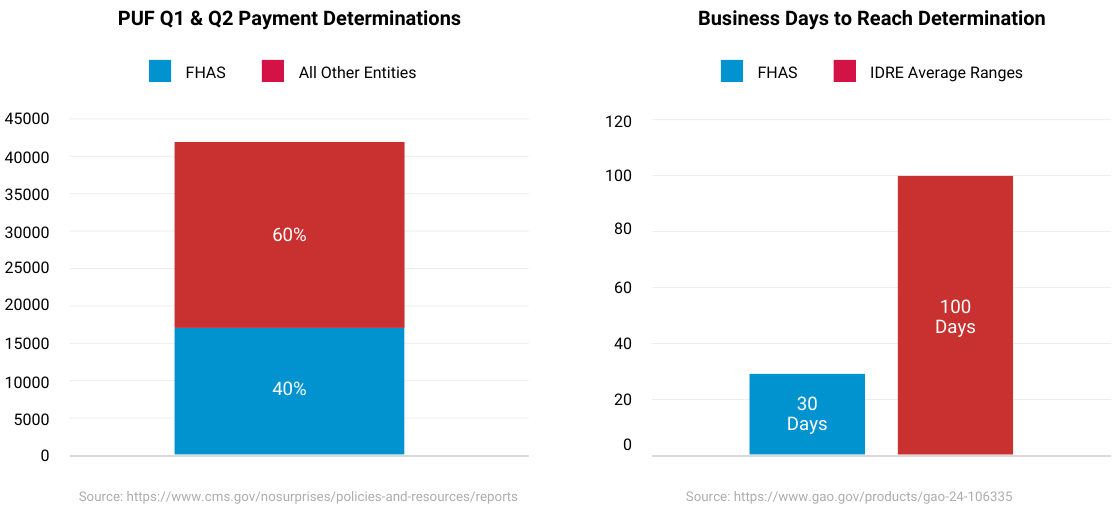

FHAS is also bolstering its reputation as the leader in IDR under the No Surprises Act by excelling in other critical metrics.

The latest available data shows that FHAS performs impressively in payment determinations and business days to reach a determination.

FHAS vs. The Overall IDR Market

Where is the backlog now?

Partner with FHAS

FHAS offers a focused approach to unbiased arbitration, compliance and efficiency that sets it apart from other IDR Entities.

Every FHAS client benefits from an impartial and efficient resolution of payment disputes between healthcare providers and health insurance plans for out-of-network services. The experienced team at FHAS follows a fair and transparent process, ensuring equal opportunity for both parties to present their cases.

Reach out to FHAS today for expert assistance with medical claims processing, dispute resolution, or customized business solutions for your healthcare organization.